The US real estate market is undergoing a quiet but profound revolution driven by technology. What was once a traditional sector based on in-person interactions and physical paperwork is now being reconfigured through PropTech (technology applied to real estate) to offer more efficient processes and immersive experiences . Investors and real estate agents are adopting digital tools ranging from artificial intelligence to 360° virtual tours, process automation, Big Data, intelligent CRMs , and property management platforms , transforming the way properties are bought, sold, and managed.

According to the National Association of Realtors (NAR), 97% of buyers already begin their home search online, marking an all-time high and reducing the average search time to just 8 weeks (compared to 10 weeks in 2019). In parallel, a recent global survey showed that around 85% of industry players plan to increase their investments in real estate technology over the next three years , recognizing that technological integration offers a significant competitive advantage. This context sets the stage for analyzing how five technology trends— artificial intelligence , 360° virtual tours , automation , Big Data coupled with intelligent CRMs , and digital property management platforms —are concretely impacting the U.S. real estate business.

📈 Artificial Intelligence and Big Data: Data-Driven Decisions

Artificial intelligence (AI) has become the new ally of investors and agents when it comes to making informed decisions in real estate. Thanks to massive data analysis ( Big Data ), machine learning algorithms can identify patterns and trends that escape the human eye, revolutionizing appraisals, sales strategies, and investment evaluations. An emblematic example is Zillow ‘s Zestimate , an automated model that analyzes hundreds of data points (sales history, property characteristics, local trends, etc.) to estimate the value of a home.

Today, Zillow ‘s algorithm achieves surprising accuracy, with a median margin of error of just 1.9% for homes for sale on zillow.com , which has made it a reference tool for sellers and buyers by estimating prices with almost appraiser-like accuracy. Behind this figure are more than 104 million homes and billions of processed data points , demonstrating the power of real estate Big Data . On the investor side, this type of AI makes it possible to project market scenarios: firms such as Jones Lang LaSalle (JLL) has incorporated AI platforms—for example, with the acquisition of Skyline AI—to predict future commercial property values and detect hidden investment opportunities in large databases. Next Deal applies similar technologies to quickly identify properties with high profitability potential, streamlining the investment process.

Smart algorithms not only estimate prices, but also learn to identify potential clients and anticipate transactions . The technology brokerage firm Compass invested nearly $900 million in developing its own AI-powered platform, including a tool that analyzes the behavior of its contacts to predict who might sell their home next. The results have been striking: its “ likely to sell ” model is accurate about 9% of the time—three times more than traditional methods or even similar tools from Zillow , according to the company. In practice, this means that with AI, Compass agents can proactively approach homeowners who haven’t even put their homes on the market but are showing signs of wanting to sell, generating new business opportunities before the competition. Artificial intelligence is also streamlining tedious, everyday tasks: Reviewing contracts and documentation to ensure regulatory compliance can be time-consuming, for example, but Compass already employs a combination of AI and human oversight to automatically validate closing documents, speeding up the process.

Another area where AI is adding value is in customer experience. More and more chatbots and virtual assistants are answering initial inquiries from interested parties 24/7. Major portals like Zillow have invested in conversational AI: in 2023, they launched a plugin that integrates their search engine with ChatGPT , allowing users to “chat” with the platform to find listings based on complex criteria in natural language. Similarly, the real estate company Redfin announced its own conversational assistant that year. Although these initiatives are still in the experimental phase, they illustrate the potential of AI to improve productivity and customer service by offering instant and personalized responses. In fact, many individual agents already use GPT-based tools to write property descriptions or analyze market information more efficiently.

Finally, Big Data combined with AI is helping institutional investors manage risk and maximize returns . Real estate investment funds use predictive models powered by economic, demographic, and market data to decide which cities are best to buy assets in or when is the best time to sell. A JLL study highlights a shift in focus: investors are moving from merely seeking cost efficiencies to using technology for value creation and risk management , through tools such as price forecasting models and integrated data dashboards . In short, AI and big data analytics have become the new “gold” in the sector: those who know how to properly exploit them will be able to stay ahead of the competition with accurate valuations, identification of emerging trends, and evidence-based business strategies. And while cases like Zillow ‘s failed experiment with automated home buying ( iBuying ) demonstrated that blindly trusting algorithms carries risks, overall AI is achieving more successes than setbacks in the real estate industry. The challenge for agents and investors is to understand these models as decision-making aids , rather than as magical substitutes for professional judgment.

🏡360° Virtual Tours: Real Estate Visits Without Leaving Home

The way we show and visit properties has radically changed thanks to virtual tour technology, 360° photography, and virtual reality (VR). Not so many years ago, interested buyers had to schedule physical visits to each property on their list, which involved time and travel. Today, however, it’s possible to “walk through” a home virtually from a computer or smartphone, exploring each room as if you were there.

This innovation became especially relevant during the COVID-19 pandemic, when travel restrictions forced the sector to adopt new ways of showing properties. The result was an exponential jump in virtual tour usage : In the month after the 2020 stay-at-home orders, Zillow reported a 750% increase in virtual tour creation compared to the previous average, and by the end of that year, virtual tour usage remained at double the 2019 level. Buyers quickly warmed to the experience, so much so that browsing a 3D tour before visiting a home became almost standard.

The adoption of virtual tours has changed historical consumer behaviors. Chart: Proportion of buyers in the United States who made an offer on a home without having visited it in person (“ sight-unseen ”). The Redfin survey shows that this percentage nearly doubled in one year, rising from around 32% in November 2019 to 63% in December 2020 , a record largely attributed to the trust generated by virtual tours during the pandemic.

“blind” offers would have been unthinkable a decade ago. Now, thanks to the possibility of touring properties remotely, 3 out of 5 buyers would be willing to purchase a home with just a virtual tour , without physically stepping foot in it, according to industry surveys. In fact, in 2020, 63% of buyers actually made at least one offer without seeing the property in person , doubling the 32% recorded a year earlier. Daryl Redfin ’s chief economist, Fairweather , said, “The virtual tour is here to stay… most buyers will eventually make offers without a walk -through. ” This cultural shift has been possible because technology has been able to replicate (or even improve) the touring experience : high-resolution 360° photos and 3D models allow you to inspect details, angles, and dimensions with remarkable fidelity.

Specialized platforms like Matterport have led this revolution: its “digital twin ” technology has captured more than 12 million real estate spaces in 177 countries , including hundreds of thousands of homes in the US, creating true virtual clones of properties. Companies of all sizes use Matterport to scan houses and apartments; Portals like Apartments.com are integrating their 3D tours and confirming the benefits: in March 2024, listings with a Matterport tour on Apartments.com received 7.4 million views in total , and users spent 20% more time exploring those ads compared to those without a tour. These are compelling figures that confirm that a listing with a virtual tour not only attracts more interest, but also retains potential buyers for longer, increasing the likelihood of generating quality contacts.

The preference for these immersive experiences is also reflected in behavior on traditional portals. Realtor.com reports that home listings that include a virtual tour get an average of 87% more views than those with only static photos, and more than half of buyers (54%) tend to discard listings that don’t offer a virtual tour . This has led virtually all major firms to incorporate this tool: whether through 360° videos on YouTube, interactive tours on real estate websites, or even virtual reality with VR headsets in new development sales offices. Some agencies offer their clients tours using VR headsets that allow them to ” teleport ” to several properties in one afternoon, something especially useful for international or out-of-state buyers. During lockdowns, Redfin agents even coordinated live video calls from properties for remote buyers, and by the end of 2020, roughly 1 in 10 Redfin showing requests were via video tour with an agent showing the home in real time. Additionally, self-guided tours with smart lock access also grew in popularity for contactless tours.

These advances indicate that showing properties has become a hybrid and omnichannel experience . The classic weekend open house now coexists with the possibility of visiting that same house on a Tuesday at 11 p.m. from the comfort of your couch, via a screen. Investors also benefit: for example, those who buy properties in another state—such as funds that acquire rental homes—can evaluate the condition and layout of an asset in detail via virtual tour before deciding on an offer, saving costly trips. It’s important to note that technology doesn’t seek to eliminate physical visits altogether (many buyers will still want to step foot in their future home before signing). However, it is filtering and optimizing the funnel : 360° tours act as a first major sieve to rule out properties that aren’t a good fit and highlight the most attractive ones, making the final in-person visits much more engaging for buyers. A Sotheby’s agent summed up this idea in an interview: “Why take the time to go see a property when you can virtually tour it first and skip the visit if it’s not a good fit ?” In short, virtual tours have gone from being a novelty gadget to a standard consumer expectation (especially for new generations of digital buyers), redefining the real estate showcase and breaking down geographical barriers in real estate buying and selling.

📊Automation and intelligent CRMs : efficiency in commercial management

Buyer behavior is evolving. New generations are looking for:

Another area where technology is making its mark is in process automation and customer relationship management through intelligent CRMs . Traditionally, closing a real estate transaction involved endless paperwork: coordination calls, in-person signatures, faxing or scanning documents, and a lot of manual follow-up at each stage. Today, many of those repetitive tasks have been automated, freeing up professionals’ time to focus on strategy and the client. A clear example is the massive adoption of electronic signatures and contract digitization : in 2022, a NAR survey found that tools like eSignature were considered “very impactful” by 79% of agents surveyed nar.realtor .

What could previously take days (sending a physical contract by courier, having the client sign it before a notary, and returning it) is now resolved in minutes through secure platforms like DocuSign or Dotloop . This change not only saves paper and time, but has also made completely remote transactions possible : during the pandemic, there was a rise in sales closings where the buyer and seller never met in person, with the entire process being carried out remotely thanks to digital signatures and online notarization . Similarly, My Next Deal uses an intelligent CRM that automates lead capture and follow-up, allowing its agents to focus on strategic tasks.

management through CRMs ( Customer Relationship Management systems ( RMS) have also taken a qualitative leap by incorporating automation and intelligence. A smart real estate CRM allows you to centralize information on contacts, properties, and activities, but its true power lies in automating follow-ups and nurturing sales opportunities in a personalized way . For example, agents can schedule email or text message sequences that are automatically sent to potential clients based on their behavior: if a prospect visits the website and looks at the same listing three times, the system can trigger an email with more information about that property or similar listings.

Real-life stories illustrate the value of these automations. Veteran agents recount how leads that took years to convert finally came to fruition because the CRM maintained a steady stream of helpful, personalized content that kept them engaged until they were ready to buy. Others recount getting referrals from former clients they never actually called personally after the sale, but who received automated congratulations on each purchase anniversary or monthly newsletters with home maintenance tips—just enough to stay on their radar authentically and encourage spontaneous referrals. This type of scalable relationship marketing would have been impossible manually when an agent manages hundreds of contacts, but with smart systems, it’s a reality.

A technology broker like Compass included features in its platform to schedule periodic follow-up emails and even send home maintenance reminders or small complimentary gifts to clients automatically . Imagine the impact on loyalty: the client receives a message in their inbox, without the agent having to remind them, one year after the purchase with a summary of the current value of their home (calculated by AI) and a congratulations; or a personalized notification like, “It’s been a year since you moved in, do you need recommendations for gardeners or painters?” These consistent, automated responses strengthen long-term customer relationships and generate service perceived as much more attentive and professional.

Of course, there’s a fear that so much automation depersonalizes the interaction. But industry best practices prove otherwise: today’s tools allow for messaging to be personalized at scale, while maintaining the “human touch” in communication. Well-designed content can sound relatable and authentic even if it’s automated, and agents still have the control to intervene at the right time. The key, as one expert points out, is that “you can create templates and sequences that sound like your own voice ,” so the customer feels consistent in the treatment. Furthermore, by removing administrative burdens from the agent (for example, manually preparing market reports for each client, something a system can compile in seconds), time is freed up for the face-to-face interactions that really matter . It’s no surprise, then, that even large brokerages are betting heavily on their internal digital ecosystems .

Keller Williams, one of the largest real estate franchisors in the US, developed Kelle , an AI-powered virtual assistant for its agents, capable of answering questions about home inventory or the progress of certain transactions simply by requesting it via voice or text. Century 21 and RE/MAX have also implemented corporate CRMs with algorithms that automatically rate the quality of a lead based on their online activity, helping teams prioritize efforts. All of this translates into a more agile, informed, and proactive sales process .

Instead of operating “in the dark,” agents now receive alerts when a client clicks on a specific property or if a certain number of days pass without contact, ensuring more timely responses. In short, automation and intelligent CRMs are redefining real estate productivity: more deals are closed in less time, with less manual effort and—contrary to what one might think—with greater effective proximity to the client , as the agent has more information and more hours to dedicate to each relationship.

🚀 Property Management Platforms: Managing Investments in the Cloud

Not only has the real estate market benefited from technology; after-sales and property management have also made a leap into the 21st century. For investors and landlords, especially those with multi-property portfolios, comprehensive platforms have emerged that facilitate daily management, tenant communication, and maintenance, all remotely and centrally in the cloud. Software companies such as AppFolio , Yardi , and Buildium offer property solutions. management that have become increasingly popular among professional administrators and landlords . For example, AppFolio – one of the pioneers in this industry – already has more than 8.7 million rental units under management on its platform in the United States finance.yahoo.com . This means that millions of rental apartments and houses are digitally supervised: tenants pay their rent through online portals, generate repair requests from a mobile app, and owners can approve expenses, schedule repairs or review the profitability of each property from a unified dashboard . For investors, the advantage is clear: scale and efficiency . A single administrator, supported by software, can manage hundreds of homes distributed across different cities, something that would have been unfeasible a few decades ago without an army of employees.

These management platforms incorporate multiple automations into real estate operations . For example, they can send automatic payment reminders to delinquent tenants, apply late fees based on pre-established rules, or notify maintenance staff as soon as a tenant reports an incident (even automatically assigning the case to an available technician and tracking its resolution). They also facilitate financial management by generating bank statements, income and expense balances by property, and preparing accounting reports for tax purposes almost automatically. For investor owners, many offer portfolio analysis tools , showing metrics such as vacancy rate, return on investment (ROI), appreciation, and more, fed in real time by operational data. AppFolio even integrates rent optimization algorithms that suggest rental price adjustments based on local supply and demand and the specific characteristics of each unit, maximizing revenue without losing market competitiveness.

Another important aspect is the incorporation of the Internet of Things ( IoT ) and smart devices into properties, which complements digital management. Smart lock systems and connected safes have enabled the widespread implementation of self-guided tours : platforms such as Rently and Tenant Turner synchronize with the calendars of vacant properties and generate temporary codes for potential tenants to visit on their own, eliminating the need for an agent to be present for each showing . During 2020, this modality exploded in the rental segment, allowing the leasing process to remain active despite social distancing. Companies such as SmartRent have taken real estate IoT a step further, offering complete packages for residential buildings with sensors and automation (access control, smart thermostats, water leak detection, etc.).

SmartRent , founded in 2017, quickly became a leader in this niche: by 2023, it had already deployed its technology in more than 680,000 rental units in the US , working with many of the largest multi-family owners. These solutions allow, for example, a manager to remotely change a lock or adjust the HVAC in common areas, and they collect data to optimize energy consumption and anticipate maintenance. One reported success story in AI + IoT implementations is that of smart air conditioning (HVAC) systems : by analyzing usage and climate data, they can dynamically adjust a building’s temperature, achieving up to 50% savings in energy costs in some residential complexes – larepublica.net . Likewise, the automation of cleaning tasks with robots or optimized routes has shown savings of up to 45% in labor requirements in office and apartment buildings that adopted these technologies . While these examples are more commercial in nature, they are indicative of how technology management can dramatically reduce operating costs.

For real estate investors, especially those focused on rental properties, all these tools mean greater peace of mind and control over their assets . Today, it’s possible for a property owner with dozens of scattered properties to receive a monthly consolidated report on their dashboard, along with alerts about vacant units or upcoming leases. They can even start marketing an empty unit on major portals with a click (as many management systems integrate with Zillow , Trulia , and others to automatically publish listings ). Online property investment platforms , such as Roofstock , have also become popular. These platforms allow buyers to purchase already-rented single-family homes in any state, as if they were stock market transactions, relying on comprehensive data on each asset and outsourced post-purchase property management. This would not be possible without the digital management infrastructure that guarantees buyers can efficiently manage that remote home through local partners and tracking software. Simply put, technology has made scaling a real estate business much more accessible: where managing more than a handful of properties was once cumbersome, today hundreds can be managed with a laptop and a good system. And for tenants or end-users, this translates into better service and faster response times —think of the difference between having to call an office multiple times to report a problem versus logging it into an app and having a technician automatically assigned within minutes.

Finally, it’s worth highlighting that this digital transformation of management also contributes to transparency and risk control . Owners can keep detailed historical records of each property (payments, incidents, improvements made) in the cloud, reducing the possibility of errors or fraud. And in times of uncertainty, having real-time data on occupancy, late payments, or tenant turnover allows for swift responses—for example, by adjusting prices or intensifying marketing in certain areas—instead of waiting for quarterly reports when the problem has already taken hold. Thus, property management platforms not only save operating costs but also empower investors with information and control , making the real estate market more attractive and efficient for those who embrace these tools.

🎯 Trend-setting success stories

These technological trends aren’t theoretical; they’re already bearing tangible fruit in specific companies and platforms in the US real estate market. As a recap, it’s worth highlighting some emblematic cases mentioned throughout the article and their results:

My Next Deal – Founded with the vision of revolutionizing real estate investing in Florida, My Next Deal combines artificial intelligence, Big Data, and automation to offer highly profitable properties to international and local investors. The platform uses predictive algorithms to evaluate thousands of properties in real time, selecting only those with the highest return potential.

Zillow Group – The leading real estate portal not only digitized classifieds, but has become a data and technology company. Its Zestimate algorithm refined automated appraisals to the point of achieving a median error of just 1.9% on prices for homes for sale, earning the public’s trust ( Zestimates are published for more than 100 million homes). Additionally, Zillow embraced conversational AI with a ChatGPT plugin in 2023 for voice searches, and its annual report showed how virtual tours skyrocketed 750% after the start of the pandemic, indicators of its successful adaptation to new user preferences.

Redfin – This company combined the role of a traditional real estate agency with that of a technology portal, managing to gain market share with a hybrid model. It invested early in 3D tours and video visits with agents, which ideally positioned it for 2020: by the end of that year, 63% of buyers nationwide had made an offer without a physical visit , according to a survey commissioned by Redfin , and views of its 3D tours on Redfin.com grew +563% in just a few months. Redfin attributes part of its growth to this commitment to technology: its agents could serve remote clients and close sales entirely online. The company also integrated AI into its value estimates ( Redfin Estimate ) and joined the generative AI wave with its own conversational assistant in 2023.

Compass – Founded in 2012, Compass defines itself as a technology company operating in real estate. It has invested more than $ 1.5 billion in its digital platform for agents, developing a unique ecosystem that includes CRM, automated marketing, data analytics, and mobile apps. A highlight is its predictive AI tool that helps its agents identify potential sellers among their contacts, with an approximate success rate of 9% (3 times higher than the average). Compass also integrated automations such as intelligent document review and workflows that have allowed its agents to close transactions faster and attract new clients through its innovative service proposal. Thanks to this strategy, Compass climbed to become the #1 agency by sales volume in several of the largest cities in the US just a few years after its founding, attracting thousands of traditional agents to its technology-powered model.

Matterport – In the virtual tour space, Matterport is a paradigmatic case. This Silicon Valley company developed cameras and software to create accurate digital twins of physical spaces. Its platform reached the milestone of 10 million captured spaces (more than 30 billion square feet) in 2023 , with adoption spanning from residential real estate to retail and construction. In residential real estate, Matterport has practically become synonymous with quality virtual tours , being used by major franchises and portals. As we saw, its integration with sites like Apartments.com resulted in millions of additional interactions and increased listing engagement time . This success led to CoStar becoming a partner in 2024. Group (real estate data giant) announced the acquisition of Matterport for $1.6 billion, seeking to expand the deployment of its AI and digital twin technologies across all of its products. The Matterport case demonstrates how an innovation can be a game-changer in real estate marketing, to the point that Andy Florance , CEO of CoStar , stated: “Today a Matterport is the new open house … people choose their next home or premises many times without visiting it, there is no better way to experience a space remotely . ”

AppFolio – Epitomizing management platforms, AppFolio is a case of how SaaS technology can scale significantly in the real estate sector. Founded in 2006, the company focused on property management software, and today its tools manage millions of leased units (8.7 million+) in the US. With a subscription-based business model and AI add-ons (e.g., a leasing assistant that automatically answers frequent tenant inquiries), AppFolio has consistently grown its customer base by ~30% annually. Many single-family home managers use it to manage dispersed portfolios with a small team, which has transformed operational efficiency in this segment. AppFolio ‘s success has incentivized other players, and today there is a competitive ecosystem of property management proptechs : from startups that manage short- term properties Airbnb -type rentals , to solutions for large institutional landlords that integrate IoT (where SmartRent stands out with hundreds of thousands of devices deployed and partnerships with multifamily giants). Together, these cases show that technological adoption is not theoretical; it is already improving key real estate business metrics : more prospects reached, faster closings, operational cost savings, and revenue optimization.

A hybrid future between the digital and the human

The impact of technology on the US real estate market is undeniable and, as we have seen, quantifiable. Sales completed entirely online, predictive analytics that fine-tune investments, virtual tours that accelerate decisions, and software that makes management scalable —all these advances are redefining the sector’s “best practices.” For investors, this means more informed and global business opportunities: they can confidently diversify geographically, supported by data and remote management. For agents and brokers , technological tools represent partly an adaptation challenge, but above all, a powerful competitive advantage when used correctly. In fact, far from displacing professionals, the PropTech wave seems to revalue the agent’s role as a high-value advisor .

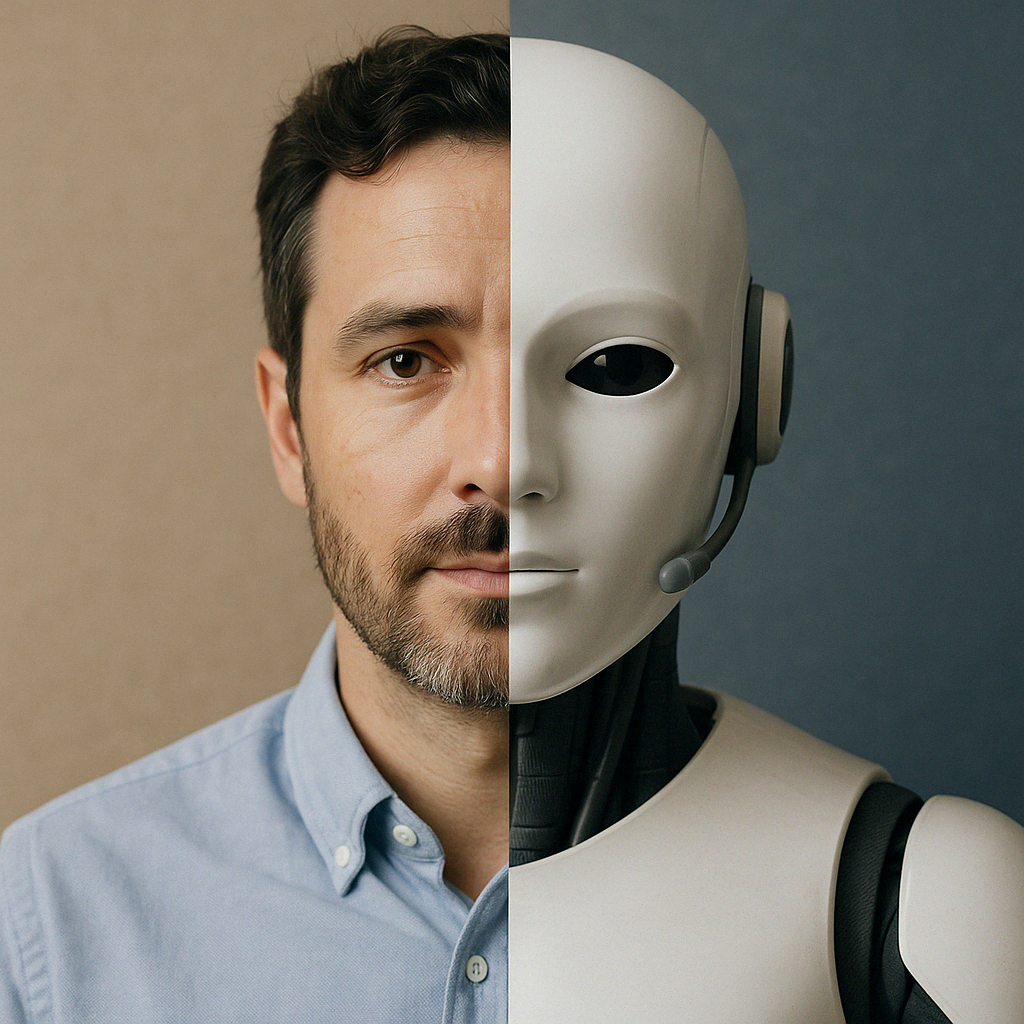

Pure transactional work (searching for listings, filling out forms, scheduling visits) tends to become automated, but expert consulting, strategic negotiation, and emotional connection with the client remain irreplaceable human domains. “AI is transforming the industry, but agents have the opportunity to use these tools to their advantage. The key is to combine the efficiency of technology with human warmth and understanding , ” aptly summarized one expert in a recent analysis of the topic on linkedin.com . In other words, future real estate success will lie in the synergy between man and machine : agents and investors empowered by data and artificial intelligence, but using them to enrich—not replace—decision-making and personalized service.

However, this transition toward a more technological sector also entails challenges and lessons learned. One aspect is the adoption gap : not all players advance at the same pace. Those who lag in adopting these innovations could see their competitiveness diminish. For example, an agent who still operates without a CRM or digital marketing will have a hard time competing for millennial clients with another who offers virtual tours, instant WhatsApp communication, and a portal with all properties updated up to the minute. Similarly, an investment fund that ignores the signals of predictive analytics could underestimate risks or leave percentage points of return on the table. In contrast, those who embrace change are reaping results: either reaching a wider audience (remember that 87% increase in views with 3D tours ) or saving resources (such as the 45% reduction in working hours in certain buildings with IoT automation ). A second aspect is ongoing training : the speed at which new tools emerge means that agents and investors must stay up to date. Many companies are investing in technology training, knowing that buying the most expensive CRM is of little use if the team doesn’t learn how to take advantage of it.

The importance of cybersecurity and data protection also emerges in an industry that handles sensitive information (client financial data, deeds, contracts). With more processes online, ensuring the security of digital transactions is crucial to maintaining market confidence. We see that even in NAR surveys, professionals position cybersecurity as one of the technological priorities for the coming years. Finally, it’s worth keeping in mind that customer experience remains the guiding principle: any implemented technology should be evaluated based on whether it improves the life of the user (whether buyer, seller, tenant, or investor). Fortunately, the evidence so far suggests a positive impact on satisfaction : buyers who can explore more options in less time and make informed decisions, sellers whose properties achieve greater exposure, tenants receive more agile service, and agents are more available to advise instead of getting bogged down in paperwork.

In short, the US real estate market is fully entering its digital age, integrating AI, automation, Big Data, and virtual experiences in increasingly natural ways. Digital doesn’t eliminate the human, but rather expands it. In the near future, we will likely see hybrid models : AI-assisted real estate agents as co-pilots , investors making decisions with real-time data dashboards, buyers touring homes in the metaverse before physically visiting them, and a transactional infrastructure so fluid that buying a property could become almost as simple as booking a flight. There’s still a long way to go, but the direction is set. Those investors and professionals who understand this transformation as a strategic ally, and not just a fad, will be in the best position to lead the next chapter of real estate . As in so many other sectors, technology has become the great catalyst for change; and in real estate, that change is just beginning to reveal its full potential.

References:

LinkedIn (2025). . LinkedIn Pulse – linkedin.com

National Association of REALTORS® (2022). Technology Survey Highlights . NAR Research Reports . – nar.realtor nar.realtor

Mynextdeal.us (2025)

Zillow (2023). How Accurate Es My Zestimate ? Zillow Learning Center – zillow.com

Redfin (2021). Survey : 63% of Homebuyers Made an Offer Sight-Unseen . Redfin News. – redfin.com

Snappr (2021). The rise of virtual tours for real estate . Snappr Enterprise Blog- snappr.com snappr.com

Matterport / CoStar (2024). Press Release : CoStar Group to Acquire Matterport . CoStar Newsroom – costargroup.com costargroup.com

JLL (2023). Global Real Estate Technology Survey . JLL Research – jll.com

Real Geeks (2023). CRM & Automation in Real Estate . RealGeeks Blog – realgeeks.com realgeeks.com

La República (2024). AI is already revolutionizing the real estate market . Interview with Verónica Alfaro – larepublica.net

GeekWire (2023). Zillow rolls out ChatGPT tool . GeekWire News – geekwire.com geekwire.com

The Real Deal (2022). Inside the Compass tech platform . TRD New York – therealdeal.com therealdeal.com